The recent fall in the Gold prices has become the talk of the town. Whether you are male or female, whether you are in office or for morning walk, the discussion is all about GOLD. Gold has always been one of the most favorite asset class for Indians. With such a steep fall, Jaipur’s Johari bazaar was queued up with buyers and many sellers were reluctant to sell as they had purchased gold at much higher prices than that of today.

Most of the people believed that it is good opportunity to buy gold as the fall is temporary and gold would once again touch Rs. 30000 levels. People believed that gold saw a correction because of crash in global markets. Today in this article we will discuss about Gold and how its prices have fared in last few years and whether we should buy gold or not.

A brief on GOLD

In true sense, gold is nothing but currency just like the paper currency or electronic currency like credit card. Centuries back, we had gold-silver coins and each emperor had its seal on it and it was used in his territory. As markets flourished and physical currency became unmanageable, paper currency came into use. In the last decade or to say during the bull market of gold, economies like US and Europe had big financial crisis and faith on paper currency especially dollar, came down drastically. Central Banks around the world which used to keep dollar as reserve currency started buying gold and so as many investors did. Due to high buying pressure, the price of gold went up dramatically. But as everything comes to an end, even the downtrend in America has come to a halt and in the last few quarters, they started growing once again. In fact, this is so evident from NASDAQ which is at all-time high now-a-days.

And hence demand for gold saw a correction in the last few quarters and we saw gold falling from Rs. 33000 to Rs. 29000. Recently, few European countries which are on the verge of bankruptcy, indicated that they will sell their GOLD reserve to meet their liabilities. This initiated this sudden downfall.

Now the question is whether one should buy gold at these levels or not?

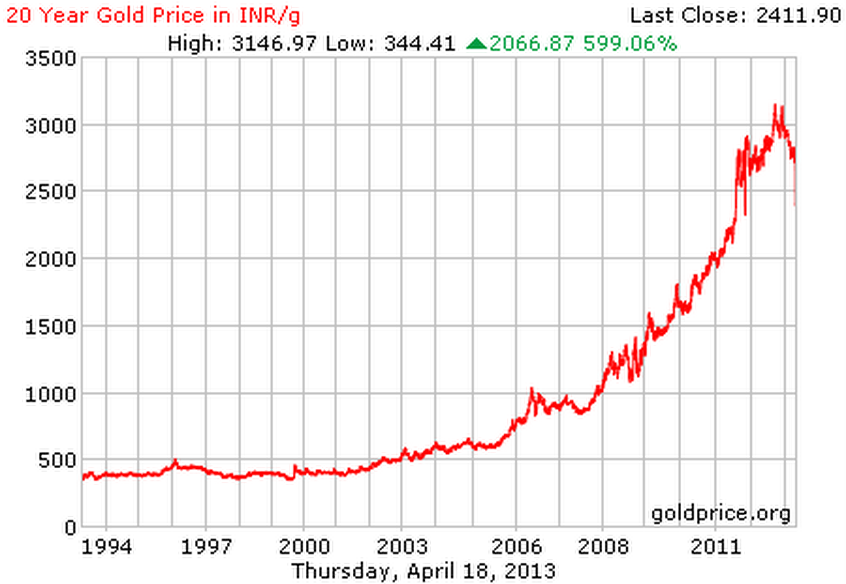

There is no YES or No to this question and it all depends on your situation. If you are interested in buying gold for your personal use like kids wedding which is due in short time, then it may make sense to buy gold and keep it. But if one is looking for buying gold for investment purpose or for kids wedding which is after 5-10 years down the line, one should think twice before plunging into gold. The graph which shows the price of per gram of gold in last 5 years, clearly shows that such sharp fall in gold price is buying opportunity as in last 5 years, gold has given fantastic returns.

But if we look at 20 year period of Gold price, you will find that gold can remain in long bear market for years and years. During 1994 to 2003, gold did not give any return.

The answer to gold price rise will depend on how economies perform. If we see growth in developed nations like US, it’s hard to see any sustainable bull market for gold. On top of it, as and when Indian economy improves and Rupee appreciates against dollar, the price of gold will fall again.

For investors, it is advisable to keep only 5-10% of their portfolio in Gold and do not go overboard on Gold just because prices have fallen.