Emergency Funds- The moment we hear this, it reminds us of our Savings A/c; isn’t it??? Most of us often confuse our Savings A/c with an emergency fund and hence believe that our savings a/c is our emergency fund.

If I go by the literal meaning of Emergency Fund – “It is that cash that one saves for the sole purpose of helping him/her maintain a normal life in times of unforeseen emergencies”. Now tell me – “Is it justified to call Savings A/c an emergency fund?” We use savings account for both our needs and wants whether it be our daily living expenses or shopping or entertainment expenses. And as the month end approaches, in most cases the balance in savings a/c tends to get to its lowest levels. So what if an emergency strikes at the month end? Never thought of it !!!!That is why it is said “In life, expect the unexpected and be prepared”.

Building an emergency fund is the best way to have peace of mind in times of unforeseen emergencies – whether it is a major car or house repair or a job loss or some major medical crisis etc.

Building an Emergency Fund

The bigger question is “What is the most suitable avenue to build an Emergency Fund?” While choosing an avenue for building an emergency fund make sure it is highly secure, highly liquid and offers stable returns. Savings accounts is what comes to our mind when we think about these features. However money lying in our Savings A/c gets slowly eaten away by inflation. Let me explain how.

Let’s assume Mr A maintains an emergency fund of Rs. 100000 in his Savings A/c which offers him returns @4%. The inflation during the year was 8%.This implies that his money actually grew @ -4% (Returns @4% – Inflation @8%) during the year and hence value at the year-end in terms of purchasing power would be Rs.96000 only.

Inflation reduces purchasing power over a period of time. So is there a better avenue to park money for emergency needs which beats inflation??? Yes!!! Liquid Fund is the best bet for building an emergency fund.

Liquid Fund

Liquid Fund is a new age financial tool which is an alternative to your savings account and offers better returns than your Savings a/c. They are highly secure, highly liquid and offers stable returns which makes them a suitable avenue for building an emergency fund.

Technically, it is a type of a Mutual Fund which gets linked to your Savings Bank account and offers you the ease to transfer money from your bank account to liquid fund and vice-versa. You can do so either through a SMS, online banking and ATM cards which you can use the way you use your other ATM’s.

To add to it, there is no minimum balance requirement, no lock in period and no limit on minimum or maximum investment or withdrawal in Liquid Funds.

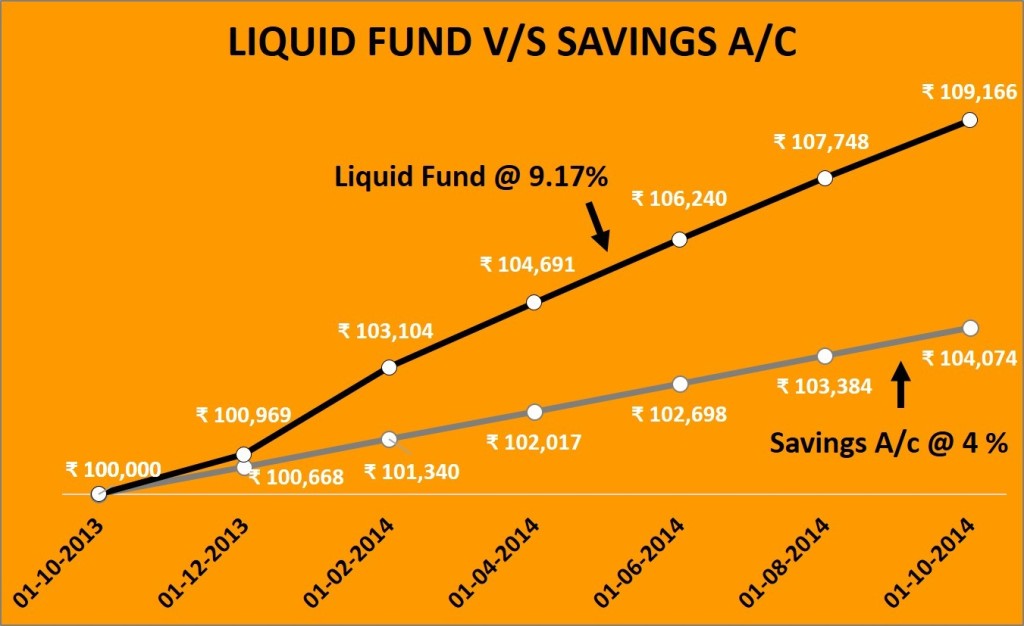

Liquid Funds offers you all the benefits which your savings a/c does. But what makes it better than the savings a/c is “RETURNS” offered by it. The graph below depicts the comparison of Liquid Fund v/s Savings Bank A/c returns:-

How big should Emergency Fund be?

Ideally emergency fund should be equivalent to 3-6 months of our basic living expenses. In case, one finds it difficult to save this amount; the key is to start small and regular. The best way to do so is to start a SIP in liquid funds which would ensure regular and disciplined savings.

Not just the emergency fund, one can also use liquid funds to accumulate money for immediate short term foreseen needs such as for paying insurance premiums or quarterly school fees of kids or other utility bills etc.

In the end, I would like to say that having an emergency fund would give us a room to breathe in times of unforeseen emergencies and we’ll sleep a lot better knowing that.