Do you think that media experts play a very crucial role in your investing success? Do you take decisions based on what gets published or is being talked about? But that’s not true! Let me explain you why is it not good for your financial health to listen all media advice that comes you way.

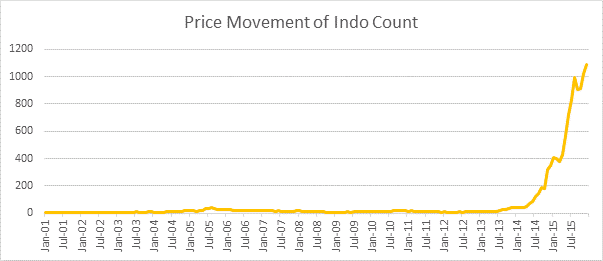

Let me take you through the very recent journey of a stock that touched the skies and how people reacted to it. The graph below depicts the price movement of a stock named Indo Count over a period of 15 years.

Amazing it looks! And if I were to ask you today “If I had advised you to buy this company Indo Count in 2011, what you would have done? You would say that you would have bought it for sure! But one of the main reasons that you think you would have been convinced about it is only because you can see a phenomenal growth towards the end.

For instance, let’s assume you would have bought 1 lac shares of Indo Count for Rs.13.75 Lacs (Rs.13.75 per share on 1 January 2011). The above graph shows that price of the stock did not move at all rather it went down to as low as Rs.6.6 per share making your investment go all the way to Rs.6.8 Lacs.

Imagine what would have happened in real time! The track record is bad and after you invested your money, it further tanked more than 50% in next 18 months. One would have gone crazy. Going by the track record of the stock, you would have literally shouted on that particular expert and would be cursing him and there’s a high probability that you must have made an exit.

But had you bought 1 Lac shares amounting to Rs.13.75 lacs on January 1, 2011 and held on to it till date, your investments would have been worth Rs.9.56 crores. But unfortunately not a single so called experts advised you to buy the stock in 2011, because there was no great past track record of it.

So when do these EXPERTS start giving you recommendations? We googled it and saw few recommendations. The excerpts of them are produced for you to analyze when this stock got attention of the experts.

The above graph shows that the stock grabbed the attention of the media experts only when it started picking up. What I wanted to convey here is that media experts can tell you about a product only if there is some track record of it. Similarly, any mutual fund scheme that has been performing well for last 3 years would get a good rating and those not performing will be downgraded. What’s the great science behind it? If one is expert, then one should be able rate a scheme which will perform better in next 3 years. But since hardly anyone does that, people start using past performance as an indicator for future performance.

So if your money means a lot to you and you really don’t want to experiment with it, stop acting on what the media experts are talking about. Remember the best expert for your money is only you. So stay put till your goal arrives.

For your reference do watch this video: https://www.youtube.com/watch?time_continue=15&v=nUjO0EdR4Ls

Published by : www.slafinancialsolutions.com