India has been the best performing stock market in Asia for most of 2018. In the last one month though, it has fallen from that status. The rupee has been the worst Asian currency this year and has fallen further down in recent weeks. Oil prices are at an all-time high. The S&P BSE sensex Index took the lowest weekly plunge in 2 years, last Friday.

India has been the best performing stock market in Asia for most of 2018. In the last one month though, it has fallen from that status. The rupee has been the worst Asian currency this year and has fallen further down in recent weeks. Oil prices are at an all-time high. The S&P BSE sensex Index took the lowest weekly plunge in 2 years, last Friday.

The overall sentiment, as they say, is bearish. And to many, it looks like it’s the return of 2008 and there’s a lot of panic. Here are a few things that you should do in the dipping times:-

Don’t panic

Doing away with your fears is a good starting point. I know it’s difficult, but that’s what you ought to start with. It’s normal for the market to go through a downward swing and get back up – it’s known as the business cycle and happens in every 5 -10 years. But in times like these, keep your investment-related decisions separate from the way you feel and trust the advice of the person who know it better than you.

Take informed decisions

If you are a long-term investor and have invested for goals that are 10-15 years away, this dip is not at all a concern for you because what’s going down now is coming back up for sure. By all means, stick to your schedule and your long-term investment goals but be wary of the reasons behind a company’s stock prices rising or falling (in case you have investments in direct equities too)

Stick to your SIPs

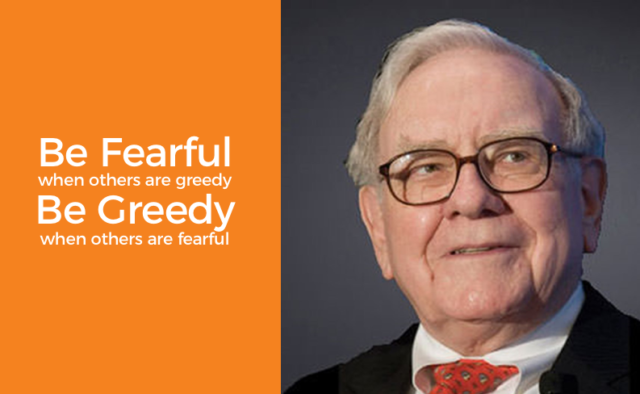

“I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy.” – Warren Buffet.

When markets are rising, we often hear people regretting over the fact that they did not invest when the markets were low. Now that markets are dipping; it’s the ideal time for you to stand by your SIPs as you will be making investments at low cost and when the cycle turns upwards; it only you who would reap the benefits of it.

Remember, staying invested in the market is a lower risk at this point than withdrawing.

Freeze!

What would you do if you came across a real grizzly bear in a jungle? You’d play dead! Do the same now. Stop bothering about what’s happening around unless you’re not an investor but a trader.

In the end, we would like to quote the expertise of investment legend Peter Lynch and his principles for investing in Mutual Funds during a bearish phase.

- The person who never bothers to think about the economy blindly ignores the condition of the market, and invests on a regular schedule is better off than the person who studies to time his investments, getting into stocks when he feels confident and out when he feels queasy.

- Investors who try to maximize returns by trying to time the market tend to invest less and those who are focused on their goals and long-term wealth creation tend to invest more.

- And finally, instead of trying to make the most money with some money, it’s better to make more money with the most money.

Remember, a strong will and calm state of mind are the two basic tools that’ll get you through these tough times.