Investment is a science just like any other activity and there are certain rules which we must follow for its effective management. But unfortunately due to lack of financial education in our academic curriculum we were never taught this science and hence we land up doing things we are comfortable with. Even fixed deposit which is by far one of the most favorite products of Indian investors, we make lot of mistakes which can prove to be fatal in long term.

For example, when most of the people go to bank for getting an FD done, they look at the different rates of FD available and then invest in a FD which offers maximum rate of interest. It used to be the case earlier that the longer term FD offered higher rate of interest and shorter term FD offered lower.But currently when you go to a bank, it’s exactly the opposite – shorter tenure is offering higher rate of return and longer tenure is offering lower rate.

Whichever way it is, investors like to put their money in a FD which offers highest rate of interest. But do think this is the right way of doing it. For instance if FD’s with longer tenure offers higher returns and you park all your money in it then then just think about it how will you meet the needs that would arise in the short term (such as liquidity needs etc.).Remember, premature withdrawals costs a lot.

At the same time, when interest rates are higher for shorter term FD‘s then parking all your money in the short term FD’s can also be hazardous for your financial health. Most of us believe that FD’s are safe but in a declining interest rate scenario even they can be risky to some extent. As far as capital protection is concerned FD’s are safe but when it comes to optimum utilization of money it can prove you wrong. Assume that you parked all your money in a 1 year FD. On maturity one may not consume the entire amount and may look to renew it but now the interest rate offered would be lower as compared to the earlier one (because of declining interest rate scenario). Had you parked some amount of money in the long term FD, you would have been earning interest rate even in the declining interest rate scenario.

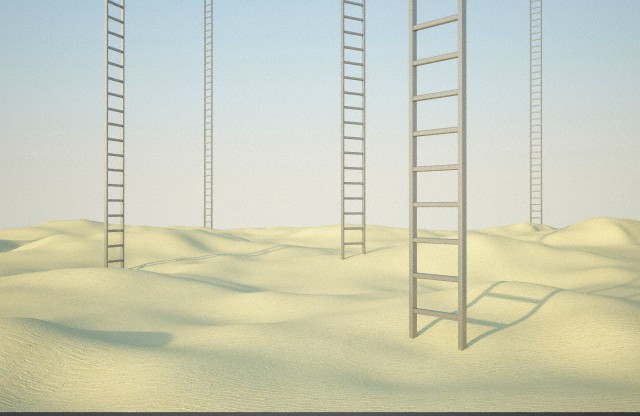

This style of investing where you choose debt products based on their maturity time is known as Ladder Based Investing.

Ladder strategy attempts to minimize risk associated with Fixed Income Securities while managing cash flows for the investor. It attempts to match the cash flow demand and accordingly investment is done in multi-maturity products ranging from short to long term. It reduces the reinvestment risk associated with the debt market while ensures a steady stream of cash flows to the investor.

Traditional Approach

Having understood the ladder style, we may follow traditional approach, that we will invest some money in 3 month FD, some in 6 month FD, some in 1 year and so on. This may be an easy approach but not the best one. Interest on FD’s are taxable U/s 56 of the Income Tax Act – Income from other sources is taxable according to the Income Tax Slab you fall in.

Modern Approach

Using the same ladder approach, here we would replace different tenures of FD with different tenures of Debt Funds. In one of our previous articles we explained how debt funds are more tax efficient that FDs. Section 45 based investments are one of the most tax efficient investments. Gains earned on more than 1 year product is taxed at 10% flat or 20% with indexation, whichever is beneficial for investor. Now with this modern approach, not only one can benefit from lower rate of taxation but can also get higher rate of interest.

For immediate liquidity – use liquid funds instead of Savings Bank Account. Returns on liquid funds are almost double than that offered by most of the banks which is by and large 4%. For 3 days to 3 months investment horizon, we should look at Short Term Debt Funds – Templeton India Low Duration Bond Fund is one of the best fund available in the industry in this category. Then for more than 1 year category, we have various other products such as ICICI Regular Savings Fund, Templeton India Short Term Income Plan, etc. For longer term product, one may choose higher maturity funds like Corporate Bond funds offered by Franklin and ICICI.

Conclusion

In the end we would like to say that the scientific approach of investments would help you to make the most out of investments. For sure, we would like to say that look at new and modern ways of investing. Change is needed to tune ourselves with the current environment. Remember people resistant to changes tend to lose a lot.