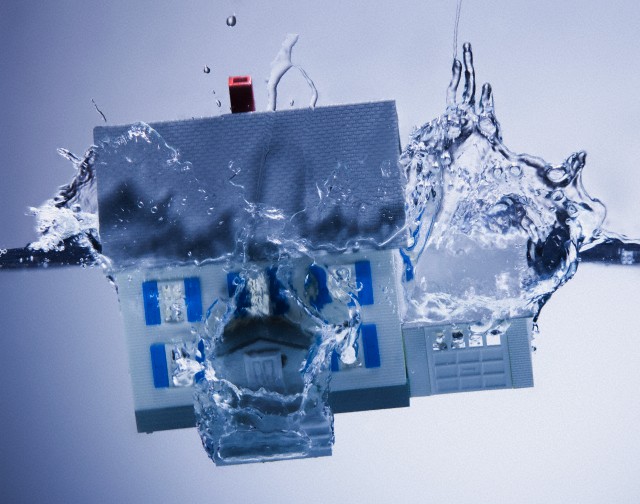

Every 20-something has an idea of what their dream home should look like. While for some bringing to life this dream comes easy, for a lot others it is rather difficult. Owning a home for those in their 20s and 30s today isn’t what it used to be in their parent’s generation. With the soaring property rates many youngsters are moving towards renting houses instead of buying and they have perfectly sound reasons for doing this. Here are some of them –: Continue reading “Why Renting a Home is Better Than Buying One?”