Few days back we wrote about the state of India economy and the bad phase our economy is undergoing. The impact of it is very evident by the way stock markets have been performing especially the equity funds. There is a wave of withdrawal in the markets and people are closing their SIP’s in a rush.

If we talk of SIP’s – SIP as a mode of investment helps in two ways.

- It enables you to save month on month and these regular savings helps to accumulate money over a period of time.

- SIP in equities also helps in Rupee Cost Averaging i.e. where we buy less units when markets are high and more units when the markets are low. This not only helps to reduce your purchasing cost but also give returns in long run.

Generally when people go for SIP as an investment strategy, the investment horizon should be long term. But the biggest problem with investors is that when markets go up, they seem to think long but when markets see a correction, the long term turns into short term. And also when they deal with agents who portray themselves as advisors they are often assured that the investments would fetch good returns. And hence our expectations rise and they start assuming that they will make money with every installment.

Undoubtedly SIP is a good way to invest, particularly in markets which are fluctuating as it captures the downside and upside of the markets. When investments are done in downward cycle, it helps in accumulating more units and when upside comes, investors stand to gain from it.But if we assume that markets would only fall, then we shouldn’t be investing at all but if we believe that markets would see a recovery, it makes lot of sense to invest when markets are real low.

Stock markets are always a bumpy ride and investors have to ride through the bumps to make money out of it. Stock market recovers from their lows as and when the economy picks up. So SIP in stock market via equity funds makes absolute sense.

Current situation

The economic condition of the economy is not good and it’s been over 5 years that stock market has not given any lucrative returns. From 21000 index to 8000 and from 8000 to 20000, it’s been a roller-coaster journey. All the more painful were the last 3 years, where markets remained in a narrow range of 17000 to 20000.In such an environment where overall economy is not picking up and markets are stagnant, SIPs have not given good returns.

So what should Investors do?

Should they discontinue their SIPs or should they continue them for long term. With all the wisdom, it would be prudent to continue the SIPs and wait for the economy to pick up. We are in absolutely messed up situations as far as economy is concerned, and it is in these bad times when stocks are cheaply available. Not to say that cheap cannot become cheaper but one day when markets will find its bottom and economy starts to recover, both cheap and cheaper will give good returns. Cheap will give good returns and cheaper will give much better.

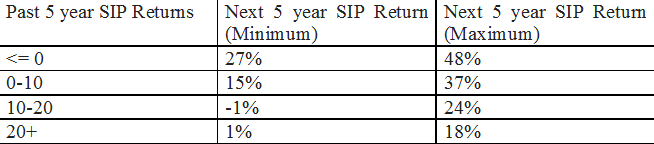

For example it has been assumed that you have been investing in Sensex from 1990 till March 2013. Since then you would have got many 5 years of investment cycle for ex. January 1990 till December 1994 is one 5 year cycle; February 1990 till January 1995 is another 60 months 5 years cycle. Likewise we would have got many such 60 months cycles. For each of these 5 years or 60 months, we calculated the SIP return and found very interesting statistics which is given in the table below.

It clearly indicates that best returns comes when you invest when markets are cheap.

At times, it looks all bad but in nature it is very right when it seems very wrong. We need to see beyond, what naked eye can see. Equities have cyclical nature, so what has come down, will go up. All we have to do is to hang on so as to make the best out of it.