It is true that 90% of the wealth is with 10% of the population and 10% wealth is with 90% of the population. But when 90% of the population starts thinking in same direction and think that by investing in any one asset class can make them rich overnight, that’s where bubble formation takes place. Presently, real estate is at similar crossroads.

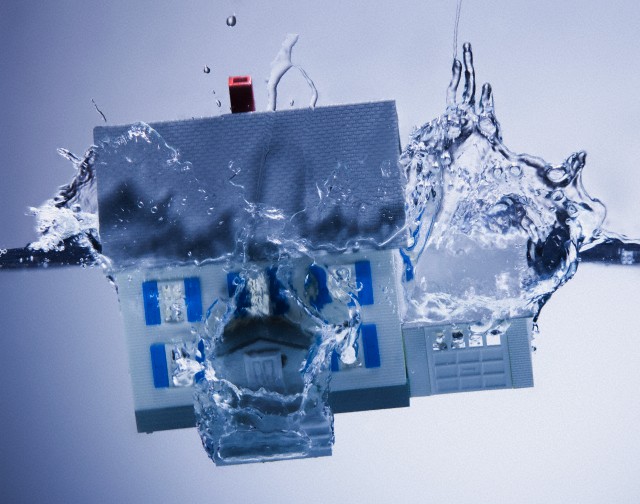

Real Estate has been the most favorite asset class and most fruitful asset class in last 10 years. But that’s history. Unfortunately that will not be the case for next 10 years. To us real estate is entering a bear phase and real estate investors will have a tough time. In many parts of the country, it has already started seeing a correction. But when we talk to public at large, maximum are bullish on real estate. Let us highlight some reasons as to why real estate could be in trouble.

Firstly, the rental yields are at all-time low. A residential property, where there has been the maximum appreciation, the rental yield are at 2%. That means if you own a Rs. 1 crore property, your rentals are close to Rs. 2 lacs per year or Rs. 15000-16000 per month. If we compare it with home loan interest rates which is as high as 10% p.a.; one can figure out the gap between the two.

Secondly, the property prices have crossed its affordability levels. In a city like Jaipur, a family of husband, wife and two kids with a salary of Rs. 50000/- per month cannot afford to have a house of their own. The average cost of 2 BHK in a decent locality is way beyond their capacity. Remember, housing is just one of the aspect of their expenses wherein one also has to shell out money on ration, schooling, commuting, medicals, and leisure and also save for future expenses like higher education, marriage, retirement etc. We would urge readers to assess whether Rs. 50000 salary in a city like Jaipur is less or not. Just think about it!!!!

Thirdly, because that real estate have given huge return in last 10 years, people have now started investing in this asset class by leveraging. Builders have a big leveraged book, investors are investing taking money on loan and loans are routed through private players which are as expensive as 24-30%.

People at large give a lot of reasons why real estate will always grow in India. For instance, when markets were rising, all reasons look justified for its further growth and when markets fell, all reasons for them to go further down seemed to be justified again. But sooner or later, every journey has to stop. One the reasons people assume real estate will rise is that our rising population will need housing and we have limited land. For a moment, if we assume it to be true, then converse of it should also be true. A country with large land bank and less population must see their land prices go down. Mind you, US has 3 times more land than us and has one third population than India which means, average US citizen can hold 9 times land than an average Indian. But in US, between 2002-2007, prices of real estate went up so high that it collapsed and in 2008 wherein we witnessed one of the biggest fall in real estate.

Well, it is true that land is limited but is it less for our rising population is a myth. India has enough land for population and more so, when land becomes dearer, costly accommodation come into existence. With technological improvements, multi-storey buildings are a reality even in the smallest cities of India. With nuclear family in place, people prefer to own flats than to have land. Things are changing so the thoughts. Black money infusion in real estate is also decreasing.

Take a general feedback from businessmen or from a salaried employee and you will find that they have made more money in real estate than in businesses or from salary income in last so many years. But this cannot continue forever. With the overall economy slowing down at a rapid pace, we need to understand that now real estate has become a liability than an asset.

All these point out to the fact that unless real estate prices come down significantly, it is not wise to invest in real estate now. Recently, Deepak Parekh, Chairman of HDFC Limited also said that the real estate market is heated up. Now correction in real estate can come in two ways – one price correction where prices come down and another is time correction where prices remain stagnant for many years and ultimately, it comes within the affordability levels due to rise in income levels of society at large. In both the cases, it may not be wise for investors to go over-board on real estate for now. Pockets where population density is high, prices may remain stagnant and places where low density like out-skirts of city or agriculture land, prices may go down significantly.