Ever heard the phrase don’t put all eggs in one basket? Of course, who hasn’t!! Well, let’s discuss how this small sentence can become a big mistake of an investor’s life. One of my colleague shared an interaction that he had with one of his clients recently. The discussion was about the financial goals that the client wanted to plan for i.e. kid’s higher education, kid’s wedding, the client’s retirement etc.

The conversation went on like this:

Client – “What do I need to do to plan for all my goals”?

Colleague – “Sir we can do this through investments in mutual funds”.

Client – “Don’t you think we should diversify and not invest all our money in mutual funds for our goals”.

This conversation looks like he asked a very valid question but before you jump on to the conclusion, let’s understand what goes wrong when people diversify in reality!

How people interpret diversification?

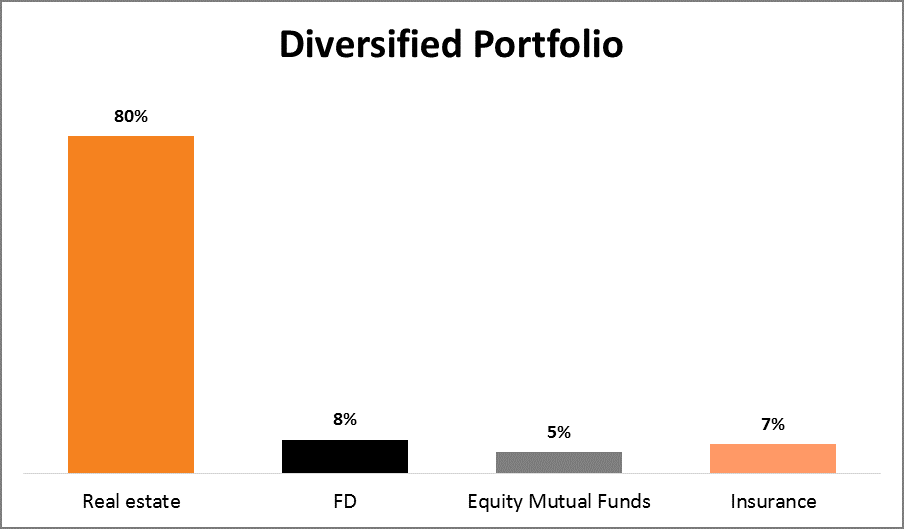

Most of the people misunderstand diversification as having a variety of investments in their portfolio. Similar was the case of my colleagues’ client who believed that he should have his investments in mutual funds, real estate, traditional policies, FD’s, RD’s etc. which would diversify his portfolio. But is it the right way to do it?

Well by doing this people only accumulate a lot of products in the name of diversification irrespective of the fact whether they need it or not. This is how people misinterpret diversification.

How people diversify?

Another mistake that people make while diversifying is “the way they diversify”. The picture below depicts how people diversify:-

It’s like performing a ritual of diversification because that’s the way people do it. But by doing so you are only harming yourself as it increases the chances of not having the money when the goals would arrive. For instance let assume you have a real estate which is worth Rs.50 lacs and suddenly a need for Rs.5 lacs pops up to pay for some goal. What would you do? Liquidate a property worth Rs.50 lacs for just Rs.5 lacs? That’s what the diversification ritual can do to you.

How to create a well-diversified portfolio?

It’s a 3-step process:-

- Identify the goals you want to invest for and

- Identify how far they are

- Follow the 10-10-10 Rule which states that

- If the goal is just 10 days (PS : less than a year) away, invest in liquid assets

- If the goal is 10 months away (PS : more than a year) invest in debt assets

- If the goal is 10 years away (PS : more than 10 years) invest in economy linked assets such as equity or real estate.

In the end I would like to conclude by saying that a well – diversified portfolio is the one which would ensure accomplishment of all your goals as and when they would arrive. Make sure your investments give you the money when your need arrives.