When We Start Earning

When we just start earning, it is only fair that we think of spending it all on ourselves, families and friends. Savings, investments, and planning retirement are the last thing on our mind. On being coaxed by elders, one might start a Savings Account and nothing more. However, at a later stage, when we try and build trust in other methods of savings and investments either because our friends/ colleagues have invested in it or the markets are performing well, we realize how much we have lost in not starting early.

Decoding Compounding

Very recently I had invited some clients to a session that I was taking. While I was talking about compounding and its benefits, a client demanded to know why he was not made to invest earlier as he regrets missing on all those years wherein he could have been benefitted from compounding as he started his investments 5 years after he met me.

While taking the session I asked my audience a question-:

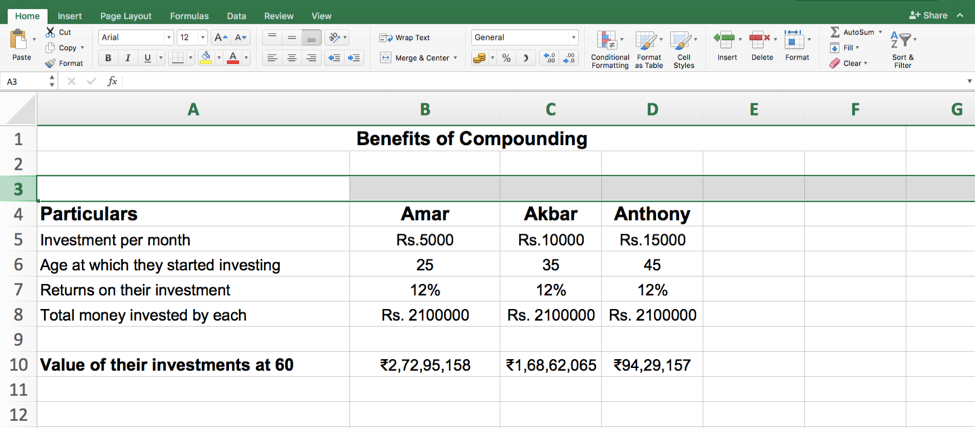

Let’s assume there are three friends – Amar Akbar and Anthony. Amar, started investing Rs.5000 per month in a vanilla equity fund when he was 25. Akbar started investing Rs.10000 per month at 35 and Anthony started investing Rs.20000 at 45. Assuming all of the three were getting same returns (12% p.a.). Now tell me who out of the three would have made more money. According to most of the people sitting out there;

Anthony would have made more money as he started with 4 times of Amar’s investments and double of Akbar’s. But the reality was something else-:

Well, looking at the image above you must have figured out who made the most money!

Looking at the above scenario; That client’s fretting over the lost years was legitimate. Had he invested the same amount earlier, his gains would have been more. But he forgot that it’s not me who did not get him started; it’s he who procrastinated and let the years pass by.

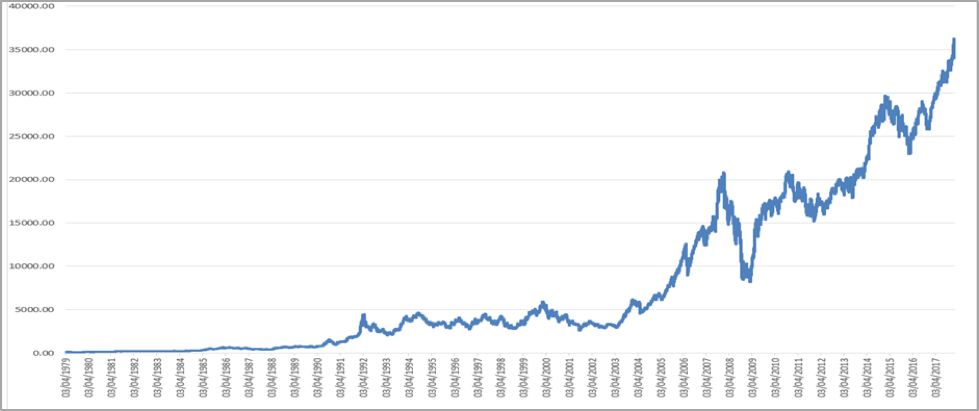

The figures that you see above are not “straight line” rise that you are thinking it to be. Such returns accrue to you only when you’ve been through troubled waters. Look at the image below-:

And this brings us to our most important lesson and cost of investment – the learning cost.

Learning Cost

In order to develop that trust and also be able to experiment, we need to start small and early. We can call this the ‘Learning Cost’. As a maturity of an investment brings gains, the maturity of an investor multiplies gains too. And it comes at a learning cost that everyone has to pay once they start understanding the dynamics of investments, savings and how it all works.