In earlier articles, we have been writing about which asset class to invest in current scenario and have covered real estate and fixed income market. In this series, we would discuss about equity market. Equity market is the true reflection on growth of economy and with the current state of economy which is in recession; markets are not performing from last 5 years.

It touched all time high of 21000 sensex in January 2008 and since then it’s been 5 years that markets have not been able to cross that level. Continue reading “Is it the right time to invest in Equities ???”

Category: Financial Planning

Things to know about Fixed Income Investments

Last week we discussed on investment in real estate and explained why investment in real estate at this juncture is quite risky. Just to recollect the discussion we said that real estate have surpassed its affordability factor and rental yields are at all-time low. With this asset class giving huge returns in last 10 years, it looks difficult that next 10 years would be as rosy as they have been in the past. Continue reading “Things to know about Fixed Income Investments”

Dont Discontinue your SIP’s

Few days back we wrote about the state of India economy and the bad phase our economy is undergoing. The impact of it is very evident by the way stock markets have been performing especially the equity funds. There is a wave of withdrawal in the markets and people are closing their SIP’s in a rush.

If we talk of SIP’s – SIP as a mode of investment helps in two ways.

- It enables you to save month on month and these regular savings helps to accumulate money over a period of time.

- SIP in equities also helps in Rupee Cost Averaging i.e. where we buy less units when markets are high and more units when the markets are low. This not only helps to reduce your purchasing cost but also give returns in long run.

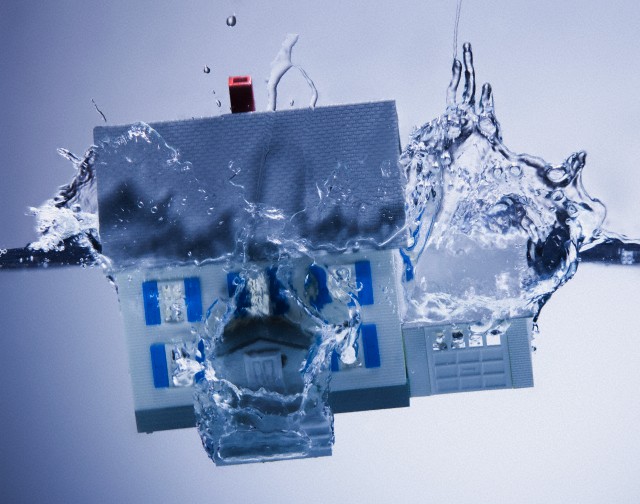

Current Environment for Real Estate

It is true that 90% of the wealth is with 10% of the population and 10% wealth is with 90% of the population. But when 90% of the population starts thinking in same direction and think that by investing in any one asset class can make them rich overnight, that’s where bubble formation takes place. Presently, real estate is at similar crossroads.

Real Estate has been the most favorite asset class and most fruitful asset class in last 10 years. But that’s history. Unfortunately that will not be the case for next 10 years. To us real estate is entering a bear phase and real estate investors will have a tough time. Continue reading “Current Environment for Real Estate”

Simple strategies would do it all !!!!

Wedding season just got over. Beautiful dresses, sumptuous food and fun and frolic all around, from outside it may look glossy and exotic but the reality is that most of us can’t stand those heavy dresses and oily food for long. The moment we reach home, the first thing we do is change those beautiful dresses and wear something which is more comfortable. Imagine what if you were to be asked to wear those shaadi-wala dress and eat that sumptuous wedding food all your life? Continue reading “Simple strategies would do it all !!!!”